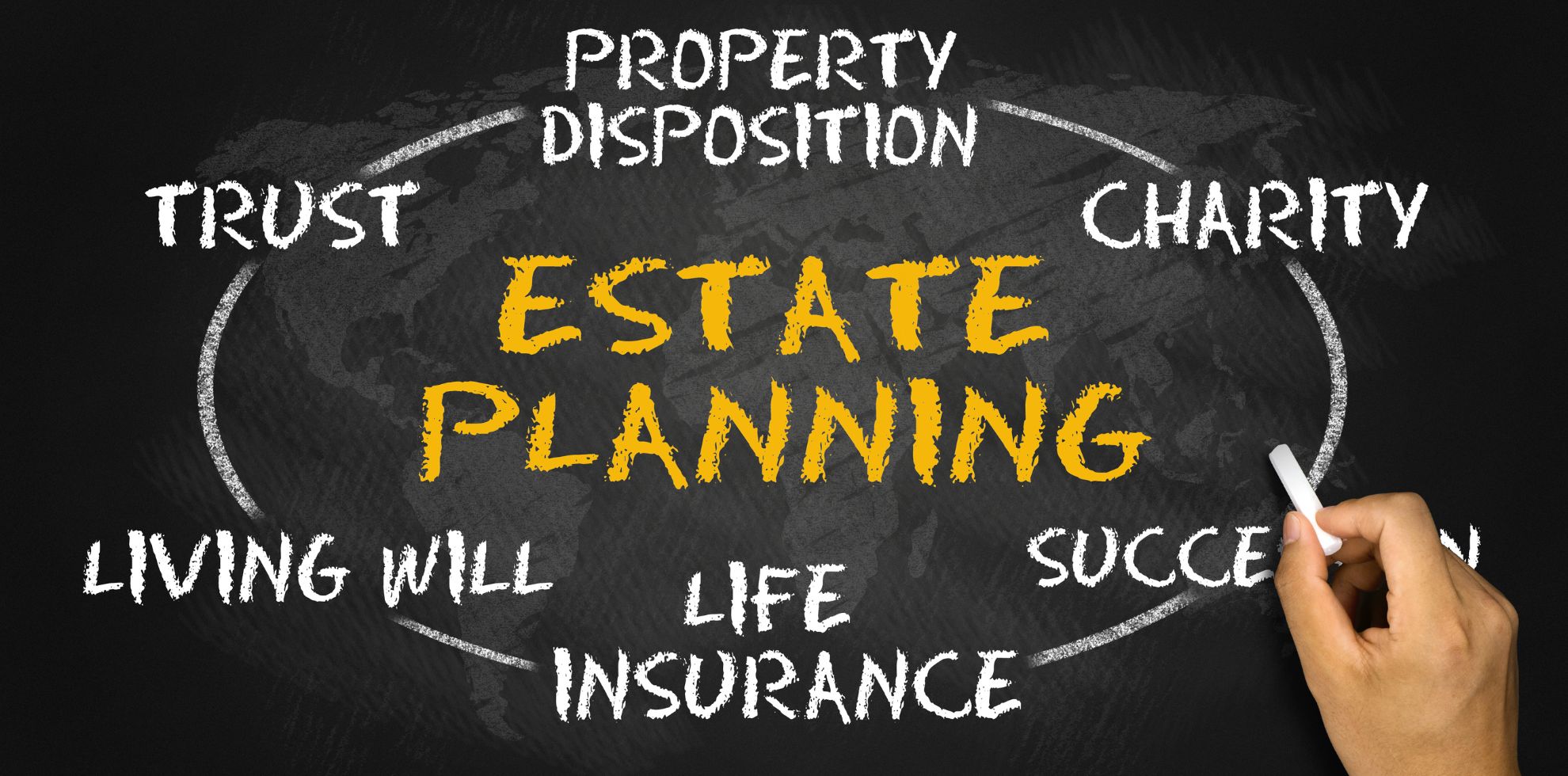

Estate Planning & Probate Attorney

For nearly 20 years, the Law office of Sean M. Tanko Limited has advised residents of Las Vegas and all of Nevada who have come to us for estate planning and probate matters (Wills & Trusts). To make an appointment, contact our Las Vegas law office at 702-463-8700. When it comes to estate matters, we believe that it’s your money let us try to keep it that way.

Probate Lawyer In Las Vegas

Losing a loved one is never easy. However, a probate lawyer can ease some of the legal complexities that may arise if an individual’s passing leaves debts and assets on the table. A probate attorney in Las Vegas, also called a trust or estate lawyer, helps advise surviving family members on a deceased individual’s assets with or without a will.

Asset Protection in Las Vegas

After working hard to make money, you want to make sure that you keep your hard-earned income rather than have it confiscated by creditors. A Las Vegas asset protection lawyer can provide recommendations on protecting your financial assets when bankruptcy, lawsuits, creditor claims, and other liabilities surface.

Let’s Protect Your Assets

We’re here to help. Reach out to Sean now to set up a free consultation.

“Sean is not your typical attorney. He is down to earth and a great communicator. I was able to leave my father with him so that he could ask him all the questions he needed to understand my father’s wishes for his estate. Sean is kind and patient and a great listener. I trust him implicitly, as does my father. I’ve been very protective of my parents as they aged. With Sean, you never have to worry. He always has the clients’ best interests at heart!”

Wendy Preyssler

Executive Coach

Sean’s Community Involvement and Organizations

Sits as Pro Tem for Probate Commissioner when needed for the Eighth Judicial District Court

Pro Bono work through the Souther Nevada Legal Aid Center

Member of the Nevada State Bar

Member of the International Rotary Club