Essential Steps to Updating Your Estate Plan

Estate planning is crucial to securing your financial future and ensuring your wishes are honored ...

What is the affidavit of entitlement in Nevada?

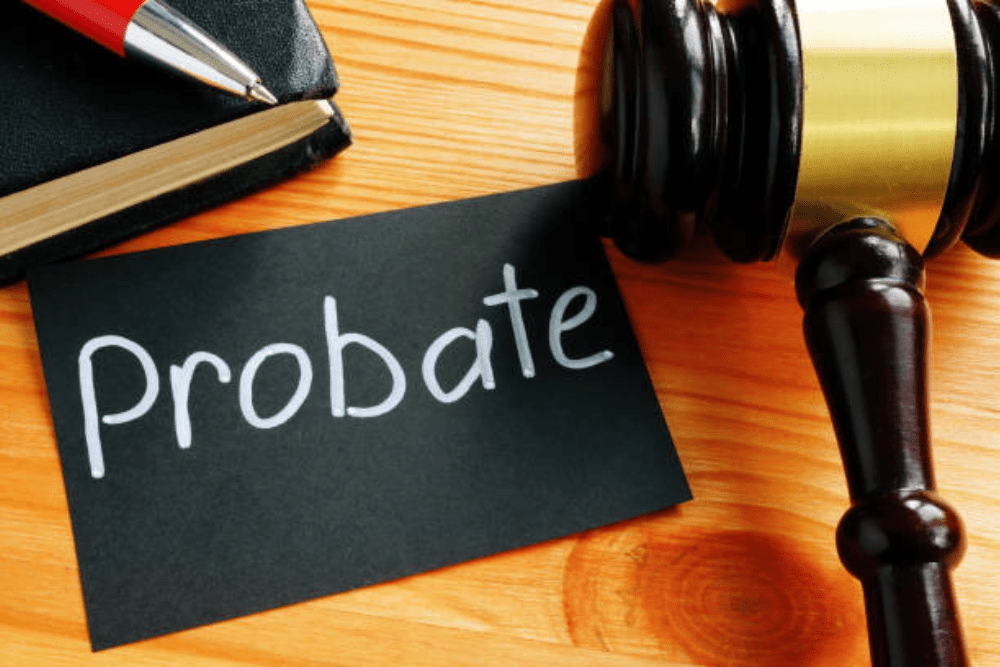

The Benefits of a Probate Attorney in Las Vegas Determining guardianship in Las Vegas can ...

What are the Birth Father’s inheritance rights?

Probate Lawyers in Las Vegas Explain a Birth Father's Inheritance Rights Much has been written ...

Nevada Trust Laws an in-depth guide

Consult a Nevada Probate Attorney About These Types of Trusts Talking to a probate attorney ...

Who’s the Executor If There’s No Will?

A Probate Attorney Explains What Happens If There's No Will If a person dies, and ...

What Happens to Unpaid Bills in Probate?

Probate Lawyer Answers: What Happens to Unpaid Bills in Probate? Any probate lawyer will tell ...